Contactless and Contact-Free Transactions Post COVID:

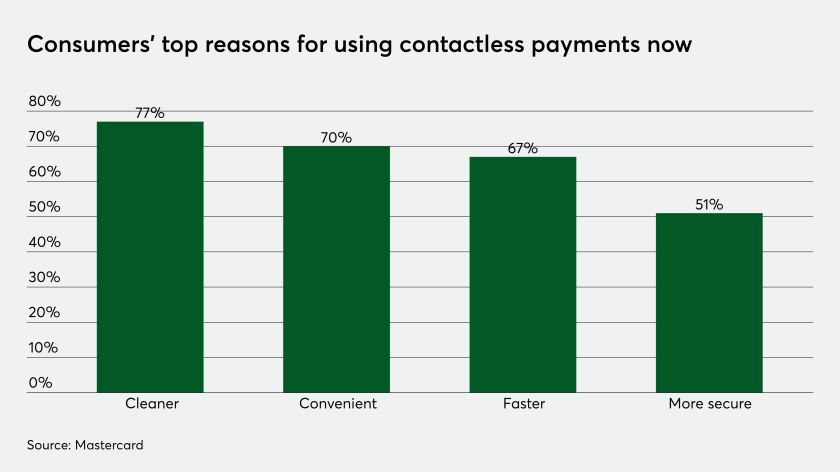

Don’t miss another episode of Truth In Data! Click on the red bell in the lower-left corner of your screen to receive notifications as soon as the episode publishes. Data for today’s episode is provided by Mercator Advisory Group’s report –COVID-19: The Power Behind Contactless Contactless and Contact-Free Transactions Post COVID: Some merchants offering EMV…

Read more