How coronavirus has warmed consumer attitudes toward contactless payments

Fears of catching coronavirus during the payment process has given a sharp boost in usage and awareness of contactless payments since the pandemic began, according to a new survey from Mastercard.

Mastercard also reports more than 40% growth in contactess transactions globally during the first quarter of 2020, according to a Wednesday press release. About 80% of contactless transactions are under $25, likely pressuring small cash purchases.

Half of U.S. consumers say they’re using cash less often since the coronavirus outbreak, and the same number say they’re using contactless payments more — and more than half of consumers seem to recoil at the notion of providing a signature at the point of sale, the survey suggests.

About a third of U.S. consumers also said they’re using their contactless card more than other cards in their wallet, which could be a positive development for large issuers like Chase, Wells Fargo, Citi and Bank of America, which began pumping large numbers of contactless cards out last year.

The data shows that over the course of several weeks, coronavirus has done something that payment industry players had failed to do on their own: jolted consumers into changing long-entrenched habits.

U.S. card issuers have been seeding the landscape with contactless cards since last year — an estimated 40% of cards have contactless capabilities, as banks and credit unions steadily replace expiring EMV contact-only cards with NFC-enabled cards.

About 60% of merchants’ POS terminals are contactless-enabled, supporting payments with contactless cards or mobile payments such as Apple Pay, Google Pay or Samsung Pay via devices and wearables.

Significantly, almost half of consumers Mastercard surveyed said they wipe their payment cards clean after using them. That could be a sign that mobile payments — which currently account for less than 10% of contactless payment transaction volume — could eventually gain more traction by eliminating the need to handle a physical card.

Almost three-quarters of consumers say they’d rather skip signing for a card payment altogether, which aligns with cardholders policies. The major card networks in 2018 dropped the requirement that merchants collect a signature at checkout, when EMV cards reached critical mass and provided a superior method of transaction verification. Large merchants soon dropped signatures, but millions of smaller merchants persisted with the formality, in large part due to inertia.

Now that more consumers are leery of handling cards and receipts, signatures are more likely to get phased out, streamlining checkouts.

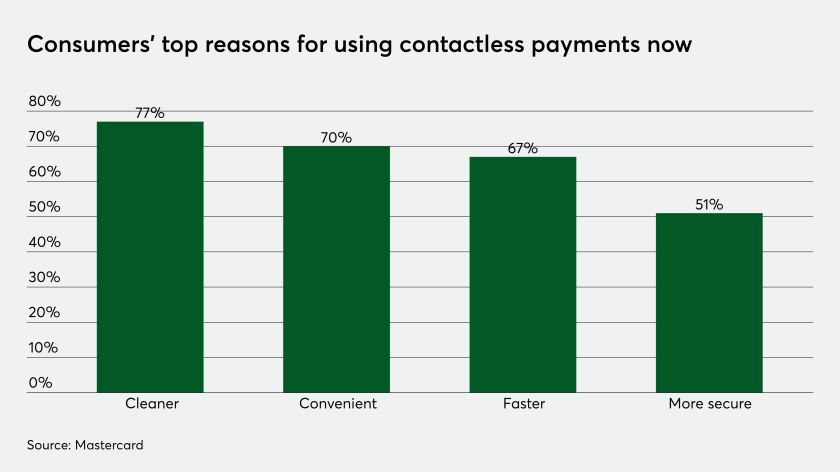

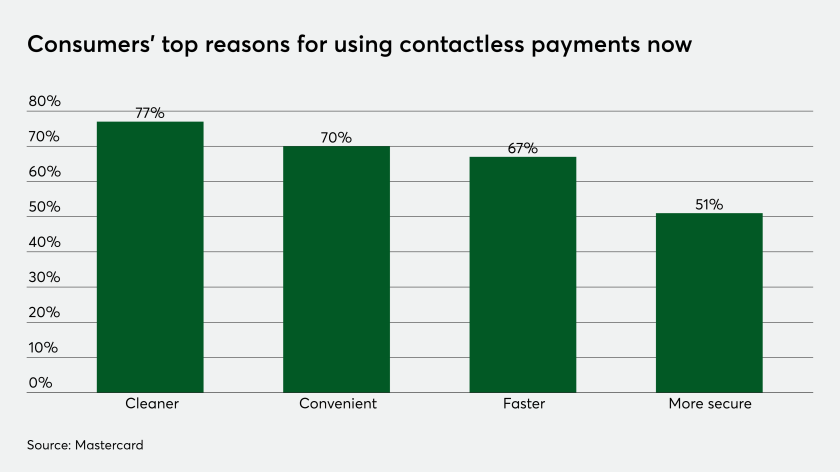

More than three quarters, or 77%, of consumers now see contactless as a “cleaner” way to pay, while 70% say it’s more convenient than cash and 67% rate it as a faster way to check out. About half say that contactless payments are more secure. Mastercard surveyed 1,000 consumers April 10 to April 12.

Supermarkets are the top location where consumers say they’re using contactless payments, at 85%, followed by pharmacies (39%), general retail (38%), and fast-food outlets (36%), while 9% mention using contactless payments on mass transit during the coronavirus.

More than half of survey respondents, or 56%, said they plan to continue using contactless payments when coronavirus fades, according to the survey.

Contactless payments Coronavirus Credit cards Mastercard Network rules NFC Point-of-sale