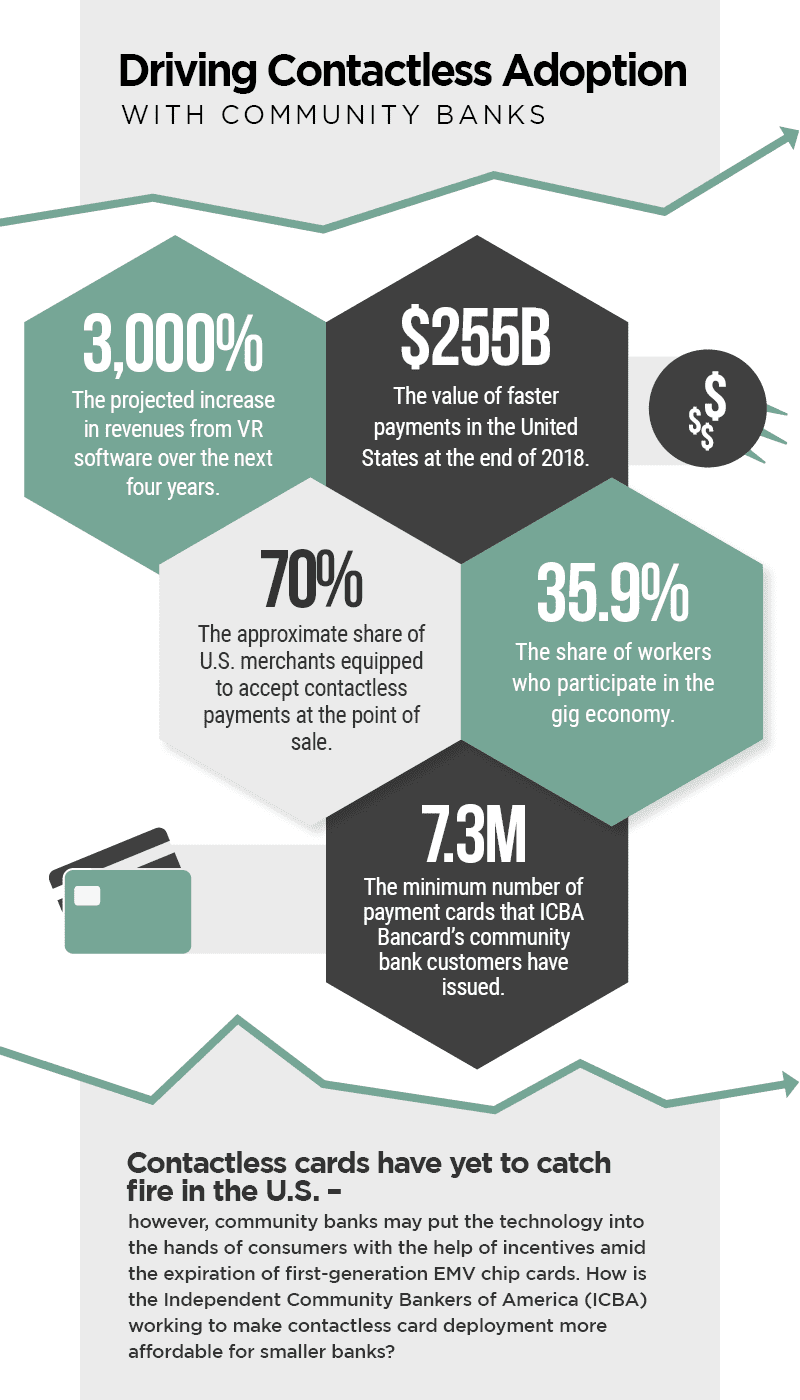

Mastercard Issuers Jumping on the Contactless Card Bandwagon

So far, Visa Inc. has dominated the headlines regarding the U.S. conversion to contactless payment cards. Mastercard Inc., however, will soon be getting into the act. “In the U.S., contactless momentum continues to grow on both issuing and acceptance sides,” Mastercard president and chief executive Ajay Banga said Thursday. “We have received commitments from issuers…

Read more