Contactless Payments: Are They Safe?

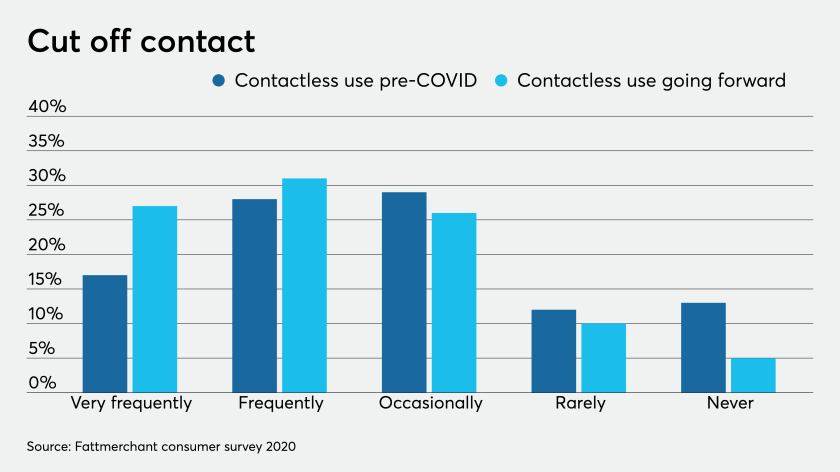

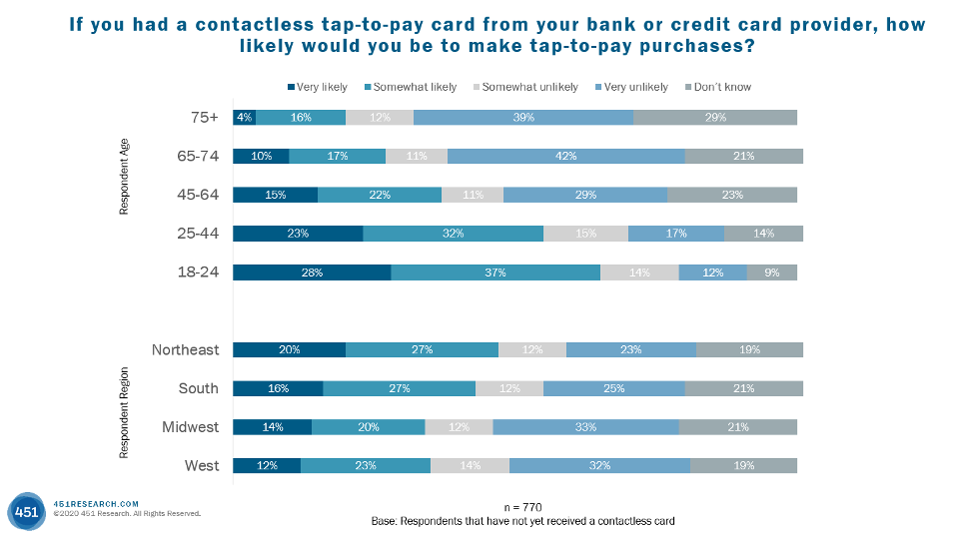

With the COVID-19 crisis and the increase of social distancing, the use of contactless payments is rising. What does this mean? Is it a safe method? Check it out! As a result of COVID-19, the use of contactless payments is expected to rise 10–15% in the U.S. according to Mercator Advisory Group Analyst Peter Reville. …

Read more