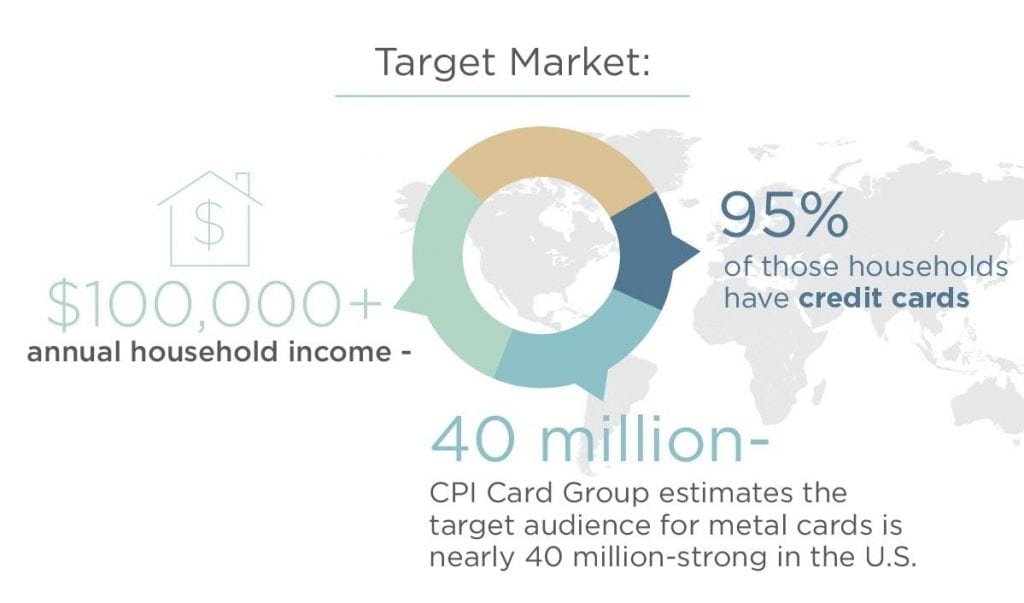

Metal cards are the latest sensation in the financial industry

DOWNLOAD INFOGRAPHIC The consumer credit card market is poised to see metal cards become the new sensation, with metal programs offering financial institutions the opportunity to win high value cardholders and fuel business growth. The rising popularity of metal cards has understandably created an eagerness among financial institutions to capitalize on the surging consumer demand…

Read more