Contactless payments: The future is here

If contactless payments were oncea solution in search of a problem — as skeptics long maintained — their moment has finally arrived.

Before the pandemic, it wasn’t much of a hassle for most U.S. shoppers to insert a physical card and type a few buttons on a terminal. Sure, some early tech adopters embraced Apple Pay. But most of us were content to pay in ways that, while a bit slower, were familiar, consistent and reliable.

With the coronavirus crisis, germaphobia is changing that calculus. “People don’t want to touch the terminal,” said Peter Reville, an analyst at Mercator Advisory Group.

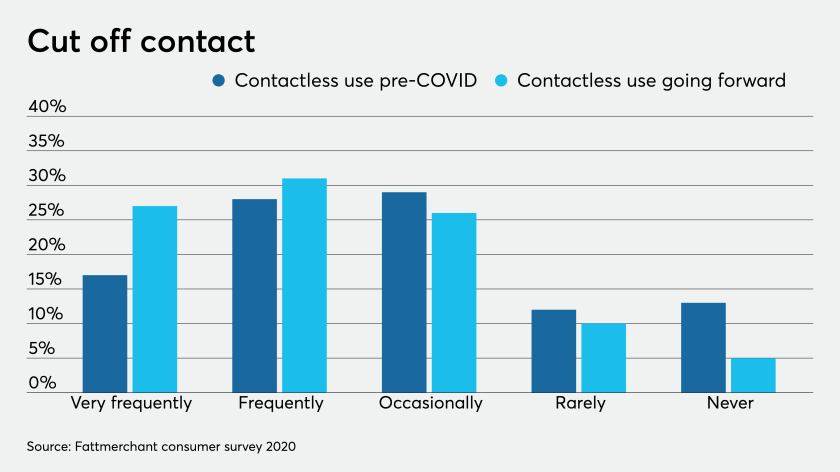

He expects use of contactless payments — whether they take the form of a mobile wallet or a touch-free credit card — to rise by 10% to 15% as a result of the pandemic.

More broadly, industry analysts expect digital payment methods, which were already enjoying rapid growth, to gain traction even more quickly as Americans change their habits.

As in-person dining was banned early on in the pandemic and curbside pickup turned into a thing, online payments, particularly using mobile apps, quickly became more ubiquitous. The eventual easing of social distancing orders is unlikely to slow that momentum, because many consumers who downloaded mobile apps when the pandemic hit have simply grown used to not waiting for their sandwiches or caramel macchiatos.