Banks Must Act Fast To Ride The Contactless Payment Tailwinds Created By COVID-19

The COVID-19 outbreak has quickly catapulted contactless payments into the mainstream consciousness thanks to their hygienic benefits. For US banks to fully capitalize on this unique messaging opportunity and ignite a longer-term behavior change among cardholders, they must ramp up the speed in which they are getting contactless cards into the market.

To date, most US card issuers have eschewed a mass conversion of their portfolios to contactless in favor of a more conservative approach. This has included leveraging natural reissuance (e.g., upon card expiration), new account issuance or customer request to gradually convert their cardholder bases. This prolonged-path contactless conversion has been a sensible strategy up until this point considering the relative newness of the technology for most US cardholders. However, given the contactless payment tailwinds created by COVID-19, financial institutions should reconsider their reissuance strategies moving forward.

Card marketers at US financial institutions should look to COVID-19 as a uniquely simple and effective messaging opportunity to drive tap-to-pay adoption. At present, the role of contactless in promoting social distancing will resonate much more strongly and widely with cardholders than the speed and convenience benefits that are often touted as the primary adoption drivers. Card issuers would be wise to accelerate contactless card issuance to capitalize on the uniqueness and timeliness of this emerging hygiene-centric value proposition. Striking while the iron is hot should also help significantly truncate the cardholder adoption curve.

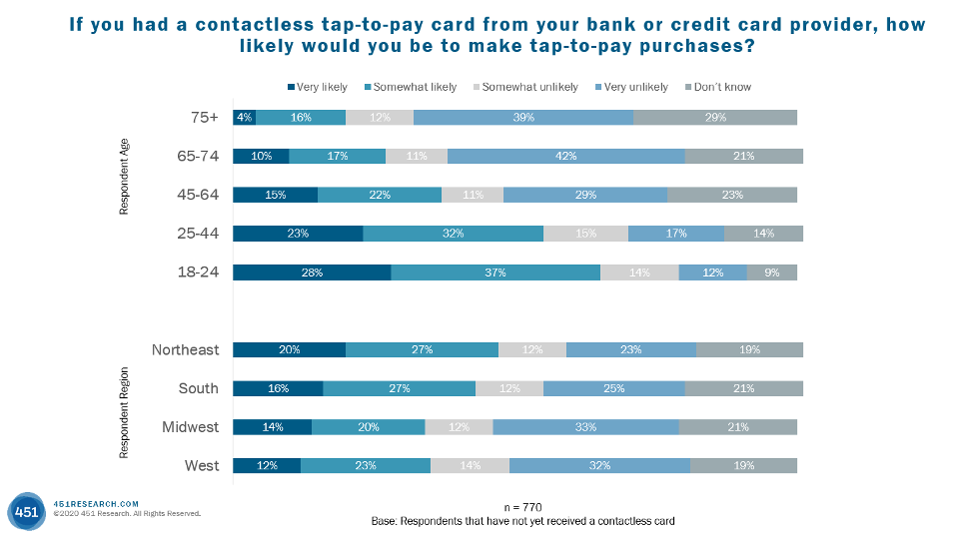

While a mass reissuance of a multimillion-card portfolio may be unrealistic for most issuers, a tactical approach targeting high-priority cardholders is not. Card issuers should weigh different demographic variables to ensure the best possible ROI on their contactless conversions. Age and geographic location are among the most important to take into consideration.

As indicated in the chart below, 451 Research’s data demonstrates that cardholders in the 18-24- and 25-44-year-old age brackets show the highest propensity to begin using a contactless card, should their bank issue them one. From a geographic standpoint, cardholders residing in the Northeast are most likely to make tap-to-pay purchases, especially when compared to those on the West Coast. When employing a tactical reissuance strategy, card issuers should closely evaluate the corresponding impact on cardholder adoption and utilization to continuously recalibrate their efforts.