Noncash payments must be part of the mix

Artificial intelligence, the so-called internet of things and self-driving cars are just a few examples of technologies that have migrated from science fiction to our everyday lives. Yet the lifeblood of society, money, has until recently largely been stuck in the realm of slips of paper and chunks of metal.

The payments landscape has, however, changed dramatically over the past few years as payment options have expanded from cash and cards to mobile payments and even cryptocurrency.

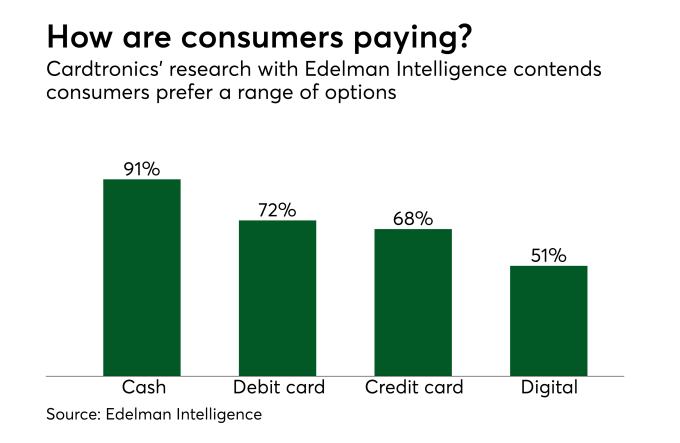

A true cashless society is not a reality yet, and may never be. But noncash payments are steadily becoming the norm for both consumers and businesses. Transactions from buying groceries or paying a car loan are benefiting from new payment options as businesses offer more flexible options for their customers, suppliers and employees. These offerings succeed only when they offer a meaningful benefit to customers or merchants.

Today, roughly 50 percent of payments made in the U.S. are still manual or paper-based, making them less efficient, more error-prone and more expensive. That’s why many businesses are looking toward new digital solutions that not only provide convenience for their customers but drive real business value, such as increased working capital from instant payment processing.

Since today’s global marketplace is ultracompetitive, smart businesses seek advantage wherever they can. Competition on price, innovation, technology and speed to market are the norm. The most innovative companies are replacing their legacy clunky, inconvenient payment methods with better experiences that make it easier for their customers to pay them, whether that be with cash, cards or electronic checks.

The best of these experiences allow customers to pay quickly, easily, and at any time of the day or night in any way they want: on their mobile phone, using an IVR, or even with cash at the checkout counter of a local store that has “lent” its POS system to another merchant to enable local payments.

One of the fastest growing trends is creating a richer user experience with expanded payment options and mobile-first payment platforms that allow customers to access their accounts how they want, and from wherever they want, to pay how they want. Omnichannel delivery systems with multiple payment options allow every customer to personalize their individual payment experience. Providing a mobile-first experience is essential, since 87 percent of adults in the U.S. have a mobile phone, according to the Federal Reserve’s study on Consumers and Mobile Financial Services.

Digital experiences also allow businesses to introduce intuitive features easily such as payment reminders, instant payment confirmation, and integration with Apple Pay and Google Wallet, which are especially useful for customers who pay with their phones. Also, as we increasingly move toward an “always on” way of life, traditional business hours don’t apply because consumers demand the ability to pay 24/7.

Essentially, going digital reduces friction to improve user experiences and allows businesses the flexibility to ask customers and vendors, “How would you like to pay me?” or “How would you like to get paid?”

Like consumers, winning businesses will demand technology-forward payment platforms that enable great user experiences that are intuitive, mobile-friendly, trust-inspiring and intuitive. Whether they process cards, bank accounts, cash or whatever comes next, digital payment systems must be reliable, flexible and ever-advancing, since, in the digital age, the only constant is change.