Merchants must improve consumer data to combat holiday fraud

Not only is the holiday season the busiest and most profitable time of year for retailers, it’s also the most lucrative season for fraudsters.

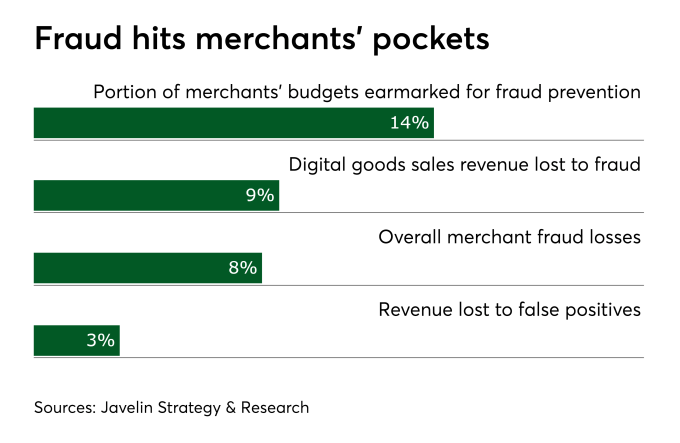

It’s easy to feel helpless. Fraudulent transactions and chargebacks can have a serious impact on your business: in 2016, e-commerce fraud grew by 31% during the holidays, costing merchants 7.5% of their annual revenue, and chargeback management can consume as much as 23% of your operational budget. It’s no wonder if you’re feeling intimidated by the threat, so don’t be caught unaware. Winter is coming, but there’s still time to prepare.

Let’s start by asking what we can expect during the 2017 holiday season. Based on ongoing trends, here are a few facts to keep in mind:

In 2016, holiday e-commerce sales grew by 17.8% and eMarketer predicts an increase of another 15.8% this year. This year, the total share of holiday sales taking place online is expected to grow 10.6 to 12%, which would mean average -commerce sales upwards of $1 billion per day in the U.S. during the 2017 holiday season.

Fraudsters deliberately target the holiday season, with more than half of annual fraud income taking place between September and December and chargeback rates increasing by up to 50% at peak shopping periods.

One of the challenges with fighting and preventing fraud during the holidays is chargeback lag. It won’t be until the end of Q1 2018 that all chargebacks for the 2017 holiday season have been reported and merchants have been notified, which makes it virtually impossible to assess your fraud rates on the fly. This is why to be successful, businesses need to anticipate their fraud prevention needs well ahead of the busy holiday season.

Worst case scenario: On top of all the expenses incurred in the form of chargeback fees, your credit card processor might suspends you for suspicious activity or your website could get temporarily shut down by attackers, causing the loss of days or weeks worth revenue during the most important sales period of the year and damaging your reputation.

Best case scenario: You significantly drop your chargeback rates, saving you huge amounts of revenue and building long-term trust with customers new and old.

You can start reducing your chargebacks right away by embracing a few good practices:

Know Your Customer. The most obvious approach to stopping fraud is to simply not let fraudsters in. Of course this is easier said than done, but you can still make an effort to verify the identity of your customers and flag suspicious activity in order to prevent fraudulent transactions from taking place. Two-factor authentication can confirm that the customer is who they say they are and automated behavioral tracking can be used to identify and block suspicious transactions which should be subject to further review.

Offer a Clear and Prompt Return Policy. Roughly two out of every three chargebacks are due to fraud, but most of the remaining third are due to customers being dissatisfied with the product or service they have purchased and wanting a refund.

Many of these chargebacks can be preventing by clearly offering a straightforward and prompt return policy. If you make it easy for your customers to get a refund, you can save yourself from expensive chargeback fees.

Optimize Your Acceptance Rates. There is no hard-and-fast rule for how strictly you should set your card acceptance rules.

Every business needs to tailor their rules to their own needs – but the balancing act can be tricky. If you make the rules more lax fraud rates are bound to go up, but if your make the rules too strict your conversion rates could plummet. Optimizing your acceptance rates is complicated but finding that perfect balance between fraud and conversion is integral to long-term success.

Tighten Your Security Features. Enable CVV (3-digit code) match and AVS (Address Verification Service) feature in your payment gateway to prevent fraudsters from placing bogus orders. Review overnight and rush orders for validation. Cross-check parameters with your fraud management system to identify fraud.

Enable Pinless 3D Secure. The most common complaint that customers use when filing a dispute is “Did not authorize transaction”. The new pinless 3D secure feature can provide you protection from fraudulent claims raised by customers on 3D secure verified orders. Enabling Pinless 3D secure feature protects you from fraud claims to a certain degree.

Chargeback prevention is only half the battle. Inevitably you will have to dispute chargebacks. Preventing fraud and improving customer service can help you reduce the subset of chargebacks in which you are at fault, but some chargebacks are genuinely caused by people trying to game the system and get something for nothing.

Understanding the rules and regulations surrounding chargeback disputes is itself a full-time job, but don’t accept “friendly” fraud as one of the costs of doing business.

Customer data E-Commerce ISO and agent Payment fraud Retailers