Community banks are missing the boat on cards

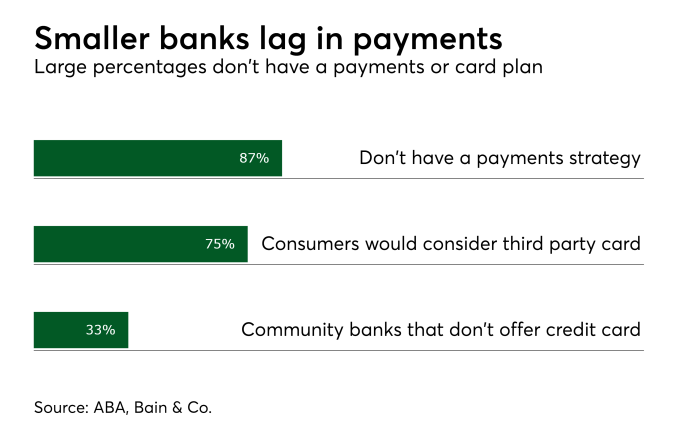

It may be surprising to learn that a recent American Bankers Association (ABA) survey reported that 87% of community banks do not have a payments strategy, given the key role that payments play for financial institutions in driving economic value and customer satisfaction.

Banks that devote the time and energy to conduct this assessment will discover it is a smart return on the investment, better positioning them to compete and protect their role at the forefront of the evolving payments arena. A strategic payments plan could shine a light on critical gaps in a community bank’s offerings; one frequently missed opportunity is credit cards.

The ABA survey reported that 33% of community banks do not offer consumer credit cards – this is a significant missed opportunity to capture a vital source of revenue. In fact, last year credit card interchange revenue surpassed overdraft revenue, per economic research firm Moebs Services.

And while a community institution might think this market is too saturated, that is a misconception. A majority of consumers prefer the simplicity of having all of their financial products from the same bank, offering community institutions yet another incentive to add credit cards to their payments portfolio. A recent JD Power study reported that regional bank credit card accounts have increased 24% since 2014, and satisfaction scores demonstrate that the offerings are staying competitive with national players.

Consumers conduct the majority of their transactions via credit cards. With the projected tsunami of growth in e-commerce and mobile payments, banks with credit card programs can ride this wave to increased profitability. eMarketer predicts that the transaction value of mobile payments will double this year and exceed $314 billion by 2020. Customer relationships with these digitally active cardholders is a gift that keeps on giving: According to Mastercard, cardholders who make multiple types of digital payments spend as much as ten times more than those that are digitally inactive, leading to revenue that is potentially two or three times higher. These digitally active cardholders are also more loyal customers.

Card-on-file, a default form of payment where shoppers are routinely encouraged to save account information on sites they frequent, represents half of all e-commerce transactions today. Card-on-file payments will see even stronger adoption as digital wallets and voice-based commerce gain more popularity.

With the card networks’ automatic card updater programs, declined transactions resulting from expired, lost or stolen cards stored on file are no longer a problem. The burgeoning trend toward invisible payments and card-on-file presents an urgent window of opportunity for banks to ensure that their customers select a credit card offered by their bank as their top-of-wallet choice.

Ironically, a large percentage of payments made with an account-on-file today are processed via the ACH network, representing a cost to the bank. This is a paradox because in an era of pervasive data breaches, many consumers prefer the security and confidentiality offered by a credit card rather than exposing their banking account number to a site that may be vulnerable. Converting these customers to happy cardholders that rely on credit cards issued by your bank can be accomplished by offering a solid rewards program.

Rewards are a proven, powerful acquisition tool: more than 60% of consumers identify rewards as the primary motivator for selecting a credit card. It’s no wonder that consumers prefer rewards-linked cards. Economists at the Federal Reserve Bank of Boston estimate that U.S. households gain an average of $240 in rewards from card-based purchases. Rewards are a significant driver of card spend and cardholder satisfaction, ultimately reducing customer attrition.

There’s one last argument to be made in favor of swift action for adding a credit card issuing program as a customer retention strategy. A new study from Bain & Co. reports that almost 75% of people between the ages of 18 and 34 would be willing to try a credit card from a “tech titan.” Sign up these customers as cardholders now, because once they select a default payment option, they typically set it and forget it.