Banks need to share info with issuers to fight ‘holiday chargebacks’

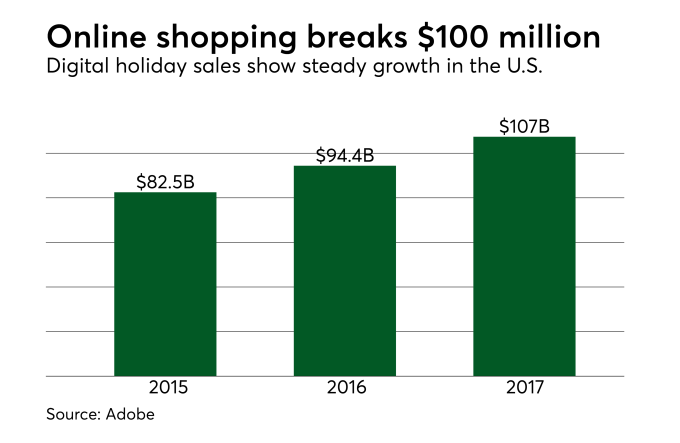

While Adobe Holiday Insights has predicted that the 2017 holiday season may be the first to break the $100 Billion mark in online sales, it’s not all good cheer for merchants.

The larger volume of sales in November and December, especially around peak dates such as Black Friday and Cyber Monday, is always followed by a distressing spike in cardholder disputes and chargebacks.

These disputes are not only due to fraud, but they can also be triggered by customer confusion over incomplete information on credit card billing statements. For retailers (both online and offline), chargebacks mean incurring fees from card issuers and acquirers and losing holiday goods and associated shipping costs, as well as loss of reputation, future sales, and customer trust.

As consumers begin to analyze the debt they’ve incurred during the holiday period, billing confusion and so-called “friendly fraud,” where customers experience buyer’s remorse and dispute a legitimate transaction, merchants and issuers face an increasingly costly problem.

The general consensus is that consumers should first dispute a charge with the retailer or service provider. However, research by the analyst firm Aite Group found that card issuers often give customers varying degrees of leeway when it comes to accepting evidence for granting a chargeback. Their report shows evidence that this process has become easier and is often abused.

Issuing banks that neglect to include merchants early in the dispute process generate an unnecessarily high chargeback volume, yet there are solutions available that can easily mitigate that problem. By inserting the issuer into the dispute process at the outset and arming them with the necessary robust data to prove both customer identity and intent of sale, we can prevent the loss of millions in sales.

Shared data can be beneficial in multiple fraud scenarios, and friendly fraud is no exception, according to Julie Conroy, a research director at Aite Group.

By leveraging emerging technologies, we can equip merchants and issuers with the right information, at the right place, and at the right time, sparing retailers the pain of losing out on thousands of legitimate sales this holiday season. This not only protects hard-earned revenue for merchants, but also helps them provide better service to consumers, allowing genuine fraud to be addressed quickly and more effectively, thus improving customer trust, retention, and loyalty.