Banks need better vision for small business payments

Most small to medium-sized (SME) business owners are highly dependent on their accountant for everything financial. Accounting, and by extension financial insights, is often a “black box” to them.

Most business owners would prefer to be more in control of their own finances so they can make better business decisions. What they really need to understand to make better decisions is their future finances. By this I mean the expected impact of a decision on their future profitability and cash flow.

Banks have data about their customers’ historic costs and revenues. When combined with a good categorization, this data can be used to forecast future finances.

These can be used to allow business owners to see the financial impact of decisions such as hiring a new employee, investing in a project or buying extra stock. Helping customers this way will also help banks. Banks will get better insight into their customers’ future financial needs which will allow them to offer the right financial products at the right time, for example overdrafts, loans or payment services, etc.

Every company has a different cost base and it is hard for banks to say which costs are appropriate and which ones are not.

Banks can, however, offer services to help businesses, such as tracking spending against budgets; controlling card payments via spend limits and virtual cards; and implementing a pre-order approval process.

Many challenger banks already help their consumers manage money by category or “pots.” Budgets are a business’ equivalent of categories and allowing small business to manage spend against budgets is therefore a natural extension of the consumer offering.

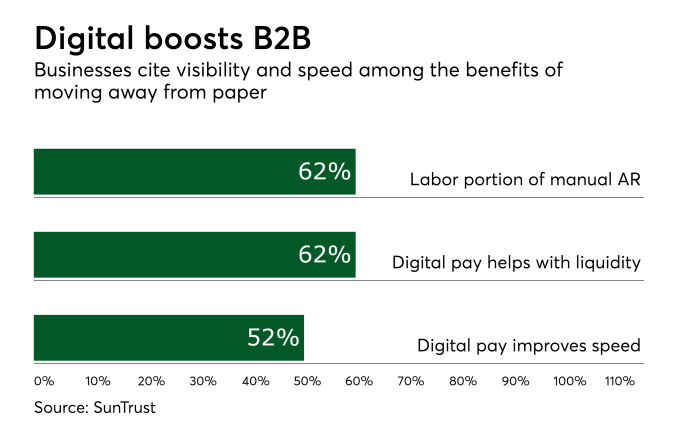

Getting paid late has a negative impact on a business’ cash flow. For certain types of businesses this can be a big problem. Many businesses, however, struggle to get their customers to pay faster.

Relatively simple steps can help SMEs greatly reduce their amount of outstanding credits. Banks can offer services to help businesses, such as allowing customers to pay invoices online by card; making sure overdue creditors are followed up with by setting a schedule, sending reminders and offering communication templates; setting and tracking credit limits for each customer, and suggesting appropriate payment terms to encourage early payment.

B-to-B payments ISO and agent Payment processing Small Business