The year of the fintech merger

While bank M&A has been largely dominated by the fallout from one deal this year — the merger of BB&T and SunTrust Banks — the fintech space remains red hot. Three significant deals in the payments and financial service provider area have already been struck so far this year, while bank and venture capital interest in fintech investments has expanded.

It’s a trend that’s likely to continue through 2019, according to experts.

The mergers of Fiserv and First Data, FIS and Worldpay, and Global Payments and TSYS so far this year reflect a race to offer competitive payment options to consumers and businesses, especially to merchants.

“In the current world we’re trending toward just one payment provider,” said Ben Cukier, partner at the venture capital firm Centana Growth Partners, only half-jokingly. “Everyone is merging with everybody. These are scale businesses — the bigger they are, the higher the marginal profits they get.”

Bank and venture capital interest in fintech, meanwhile, remains as strong as ever.

“We see no signs of banks’ investments in fintech abating yet,” Cukier said. “Right now, their investments are performing well; they’re getting great market returns and market intelligence.”

Following is a detailed look at what’s driving merger and investment activity — and how it is likely to play out for the rest of 2019.

A wave of mergers

Incumbent payment providers are consolidating to cut costs and offer end-to-end processing to their customers, according to Lindsay Davis, senior intelligence analyst at CB Insights. Fintech competition is also a driver.

“Stripe is moving further across the payments sector and globally they’re expanding,” Davis said. “That’s a signal for the incumbents to figure out their own growth strategy, because there are end-to-end services being created outside and they don’t necessarily want to watch that business go out of house. The incumbents are starting to wake up to the fact that technology is very much here and they can also benefit from it. Everyone’s becoming more customer-centric and that’s in the DNA of the startups.”

Among pure fintechs, Plaid’s purchase of Quovo for $200 million is widely considered the most significant.

“Plaid in the U.S. has enabled fintechs and incumbents to go through digital transformation, and that gives them both the ability to service customers more quickly and iterate on products,” Davis said. “By acquiring its nearest competitor, Plaid now has the ability to grow products, services and distribution rather than compete on price.”

Its also a likely sign of things to come.

“The use of M&A to accelerate product, service and market expansion is a trend that I think we’ll continue to see, rather than companies building everything themselves,” said Jeff Silberman, counsel at Reed Smith.

Banks’ interest in fintechs

Banks have also been stepping up their investments in fintechs this year.

Goldman Sachs has been especially active. It’s invested in the U.K. robo-adviser Nutmeg and co-led a fundraising found for the U.K. PFM provider Bud — in both cases to shore up its budding Marcus business in England, which has gathered more than 250,000 customers and taken in more than $8 billion in deposits in less than eight months.

The bank also led a $44.8 million Series C fund raise for Nav, a provider of free credit reports for small businesses and matchmaker for small businesses seeking loans with lenders that want to make such loans. It led a $31 million Series B financing round for Built Technologies, whose construction lending software is used by 80 lenders, including Regions Bank.

And Goldman led a $22 million funding round for Unqork, a “no code” tech firm. “No code” means the customer can create apps without having to write code, or writing very little code. Goldman plans to use Unqork for onboarding clients, especially in the private wealth area.

Wells Fargo, meanwhile, led a $17 million Series C funding round for OpenFin in May that JPMorgan Chase and Barclays also joined. OpenFin provides an operating system for financial applications that’s meant to create an Apple App Store-like environment, where applications are compatible with the devices they run on and with one another.

Also in May, Citi invested an undisclosed amount in ChartIQ, which has desktop integration technology. Like OpenFin, it intends to unify the desktops of financial institutions.

VC fintech funding

Venture capital investments in fintech firms so far are about on par with 2018. In the first quarter, the number of VC-backed fintech funding deals rose 4% quarter over quarter, but the amount of funding dropped 13%.

Cukier expects VCs to be generous during the second half of the year. He said that when he started investing in fintech companies in 1999, people would often ask him why.

“Fintech investing is now cool, or at least cool-adjacent,” he said. “People are talking about fintech. There’s a certain aura. I like to think part of that has come from the fact that investments in this space have done well and made a lot of money.”

Payment-focused fintechs will continue to attract investment, he predicted.

“You’ve got the electronification of money, it’s getting faster, better, and there’s lots of demographic trends that will support the continued value creation in payments,” Cukier said.

His company is particularly interested in vertical apps — business applications that get payment capability woven into what they do. A high-profile example of this (not in Centana’s portfolio) is Mind Body, which makes software that manages yoga studios, salons and other retail businesses and lets people book appointments with payments in the background, similar to Uber. One Inc., a company in Centana’s portfolio, offers similar software for property and casualty insurers.

“Today well over 50% of payments still happen in cash or checks,” Cukier said. “Which in 2019 is almost head-scratching.”

There have been some notable VC fintech fundraisers in 2019 already. The online challenger bank Chime announced a $200 million funding round. It’s now valued at around $1.5 billion. The company expects to double its number of employees and its operation.

Figure Technologies, SoFi founder Mike Cagney’s new online lending fintech, which provides home equity loans, raised a $65 million Series B — impressive given the company is only a year old and Cagney left SoFi in a cloud of scandal.

The online lender Upstart raised $50 million in a Series D round with investors Progressive Investment Co., Healthcare of Ontario Pension Plan and First National Bank of Omaha. And Chainalysis raised $30 million in a Series B led by Accel and joined by Benchmark. Chainalysis has software for monitoring cryptocurrency transactions that’s used by Barclays and more than 100 other financial institutions.

Fintech-bank partnerships will pick up

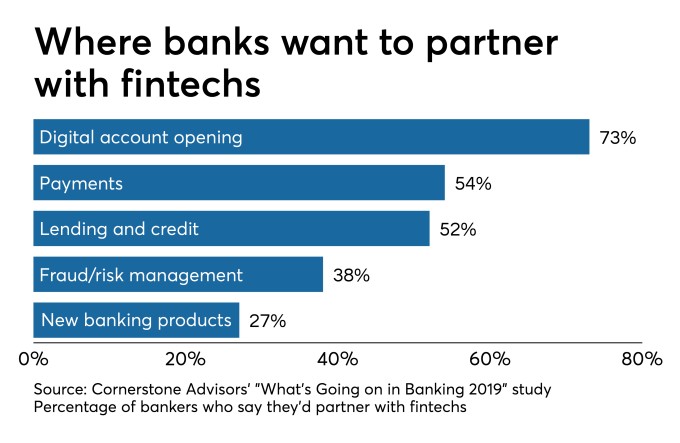

Silberman predicts that partnerships between fintechs and banks — like the ones between T-Mobile and BankMobile and between Apple and Goldman Sachs announced earlier this year — will accelerate in the second half as they have over the past few years.

Even fintechs that bill themselves as disrupting financial services, such as online lenders, will likely succumb to this trend, Silberman said.

“Recognizing that traditional financial institutions have inherently a cost-of-capital advantage, the concept of partnership has increased,” Reed said. “And banks and credit unions certainly see the efficiency and value of partnering with third-party fintechs.”

This will also add to banks’ vendor management burden, he noted.

“While these financial institutions are gaining a greater user experience for their customers and greater service and product offerings in some circumstances, and efficiencies around those business lines, there’s also the added burden of increased vendor management and oversight over those vendors,” Reed said.

In a related trend, Reed sees fintechs that sell products to banks and credit unions expanding those relationships with added products and services.

Blend might fit this case. It started out offering digital mortgage software to banks. Once it gained some bank clients who were happy with the product, the banks started asking Blend for technology to help with other challenges, such as digital account onboarding.

“It’s a win-win on both sides,” Reed said. “The fintech platform gets to deliver more product and service to its financial institution clients. And the financial institution clients who are engaged with the fintech platforms have the ability now to have more of a one-stop shop where they can look to a smaller number of vendors for a greater amount of products and services.”

Disruptors Fintech Fintech regulations First Data FIS Fiserv Goldman Sachs JPMorgan Chase TSYS Venture capital Venture funding Worldpay