PayThink Contactless payments is EMV’s ‘fast solution’

Recently, my son and some of his friends were hurrying to catch an “L” train in Chicago, and it tends to be the way of things that when you are rushing to make a train there are long lines at the ticket machines.

Fortunately, my son was equipped with a contactless EMV card which meant he could simply tap his card at the entry turnstile and proceed to the train, while his friends had to wait at the ticket machine.

A quick anecdote to demonstrate why the U.S. is rolling out contactless cards so quickly on the heels of EMV — speed and convenience, and without sacrificing any of the security of EMV chip cards.

One of the few advantages of the old magnetic stripe cards is that it was a fast experience, whereas with EMV chip cards there is a delay of several seconds after the card is inserted into the point of sale terminal. When using a contactless card, instead of inserting the chip cardholders just hold the card within an inch or two of the terminal — a light or a chime will let the cardholder know it has read the data, then their work is done. So fast, in fact, that the first time a cardholder carries out a contactless transaction they may wonder if it actually worked.

As with any new payments innovation, there are inevitably concerns and reservations. New research from Fiserv found that the majority of consumers are aware of “tap and pay” capabilities, with just over a third of consumers having a credit or debit card with such capabilities. One in five have used contactless payments but consumer interest is divided. The majority of consumers express some concern about the safety of contactless payments, but such concerns are wholly misplaced.

Contactless EMV cards are every bit as secure as their contact-only EMV counterparts, and fears that criminals could remotely steal card data and commit fraudulent transactions are unfounded. Contactless cards can only be read within a few inches and the information available from a contactless transaction is insufficient to create a counterfeit card. It doesn’t even include the cardholder’s name. In short, contactless cards offer the same strong security provided by contact-only EMV cards by producing a unique code each time the card is used.

Contactless cards will prove to be a positive evolution for consumers, merchants, and card issuers alike. Contactless cards are ideal for small purchases such as coffee or lunch, and as mentioned when people are on the move, through transit turnstiles. The contactless purchase experience is so easy and quick that it is at least as fast as paying with cash. Issuers stand to see increased card usage and decreased dependence on cash, leading to lower operating costs and new avenues of engagement and revenue.

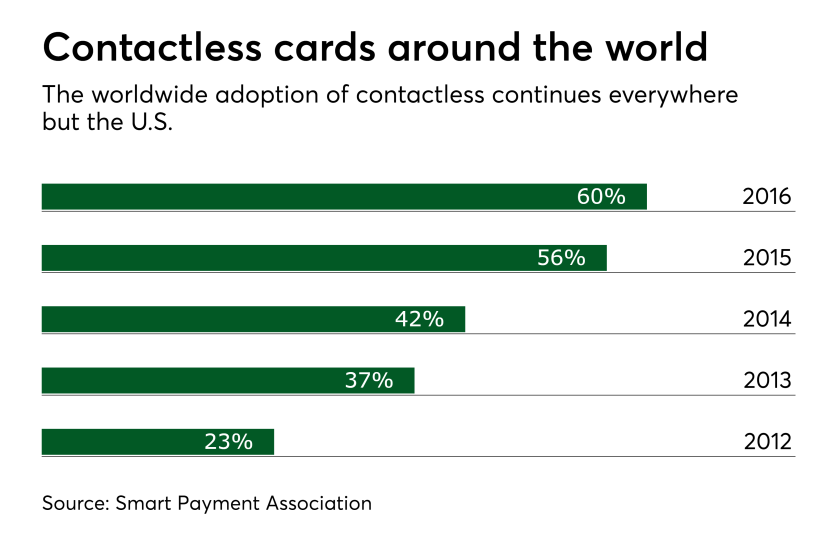

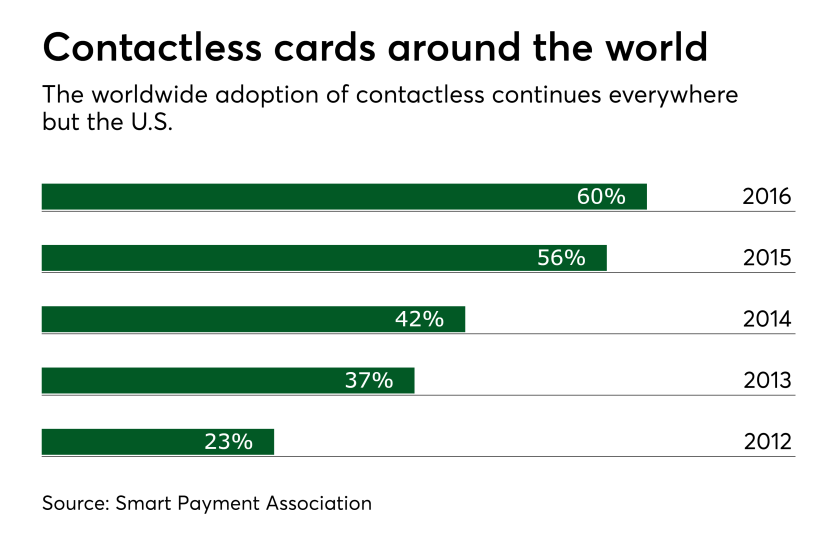

Adoption of contactless is already well under way, and in a few years consumers will likely look back and recall the bad old days when valuable time was taken up waiting for transactions be processed and wonder how they ever coped without the speed, ease and convenience of contactless payment cards.