Data: Who wants contactless cards?

The U.S. may be next to see a surge of contactless credit cards, following other major markets around the world. In many locales similar to the U.S., consumers tap to pay for about 20% of all in-store transactions using Near Field Communication-equipped cards, far surpassing the number of mobile payment users.

But it’s unclear whether enough U.S. consumers are interested in contactless payments for issuers to make the investment.

U.S. issuers previously shied away from contactless cards for several reasons, including the relatively low number of NFC-enabled merchants and the cost of overhauling card portfolios just a few years after the painful 2015 EMV liability shift. But recent moves by key merchants and issuers could spark a change, depending on how consumers respond.

The main reason the U.S. lags behind other global markets in contactless adoption is the low level of support for NFC payments at the point of sale.

Most U.S. payment terminals are built to accept NFC, but many merchants—including influential giants like Walmart and Kroger—balk at enabling the contactless feature for their own reasons.

But changes may be afoot. Two major NFC holdouts—CVS and 7-Eleven—will soon add contactless payment support in stores, Apple Inc.’s CEO Tim Cook told analysts in late July. And this month Costco activated in-store contactless payments, rounding out the use case for 7 million-plus U.S. consumers with an NFC-enabled Costco Anywhere Visa credit card. (Citi, which issues Costco’s cobranded card, made the decision to add NFC to the entire portfolio when it launched two years ago.)

The U.S. Payments Forum reports that active contactless-enabled payment terminals are approaching 20% of the U.S. market, an increase of more than 100,000 terminals within the last year. That pace is expected to continue, said Randy Vanderhoof, the forum’s director.

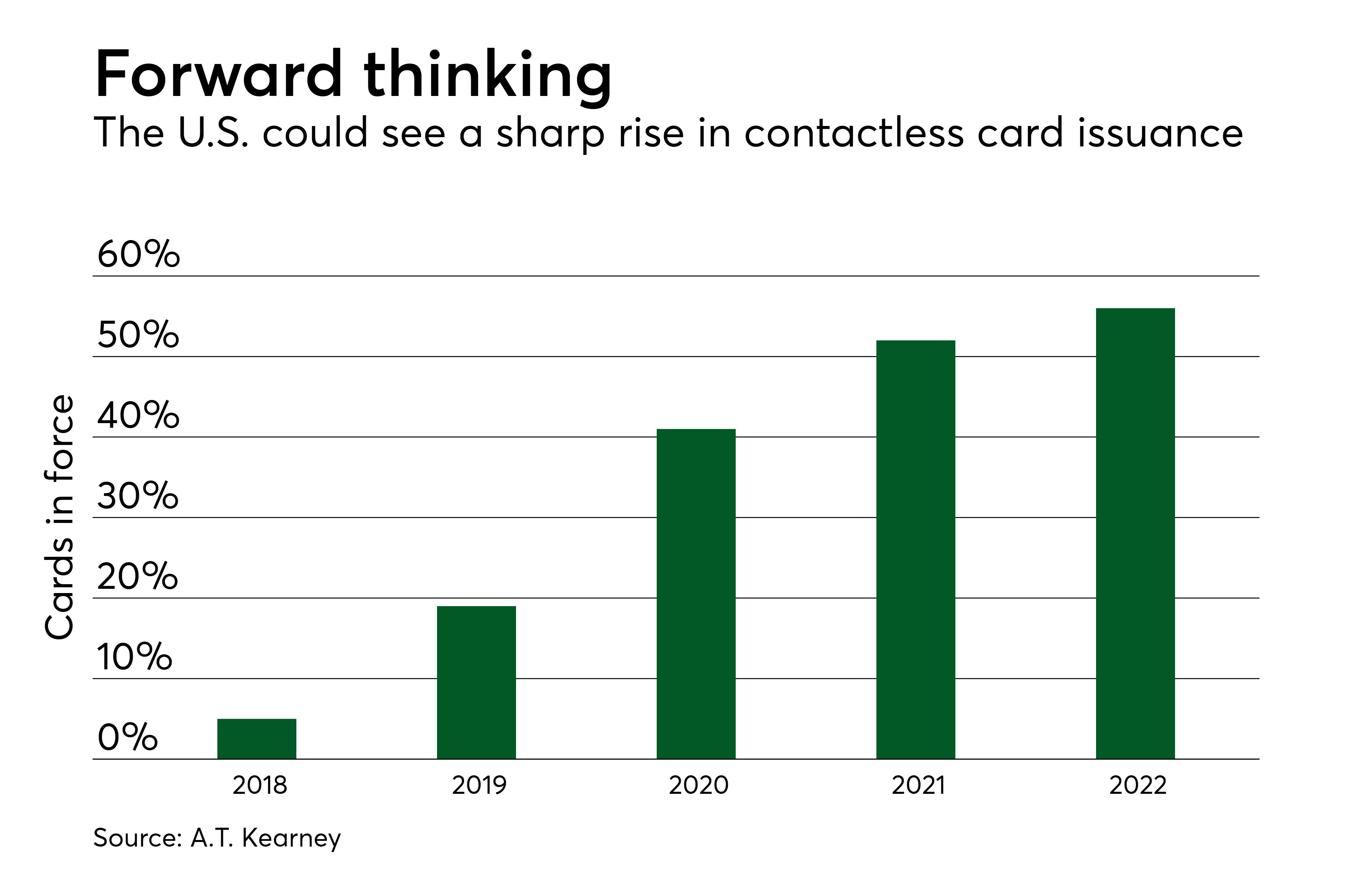

Some recent studies indicate U.S. issuers are poised to unleash more contactless-enabled cards. It’s still theoretical, because less than 5% of cards in circulation in the U.S. have contactless technology and no major issuers have disclosed plans for a mass issuance of contactless cards.

Burned a decade ago by overestimating U.S. merchant interest in the first wave of contactless cards, most U.S. issuers pulled back sharply on NFC, and focused solely on making credit and debit cards EMV-compatible. The U.S. Payments Forum indicates many banks will begin issuing contactless versions of credit and debit cards beginning next year, when the first generation of EMV cards begins to expire.

A.T. Kearney, in a new report based on data from Visa and other payments industry providers, predicts a sharp increase in the critical mass of contactless cards over the next two years, resulting in 4 in 10 U.S. cards equipped with contactless technology by 2020.

“Many card issuers have dual-interface cards in the plans for the next reissuance cycle,” said Vanderhoof in the U.S. Payments Forum’s recent summer report on the state of cards.