Credit unions are buying more banks. Get used to it.

The more bidders, the merrier.

That philosophy among small-bank sellers is driving the increase in credit union acquisitions of banks this year, and it’s a big reason the trend is expected to gain further steam.

More sellers are inviting offers from credit unions — in addition to putting out the normal feelers among banks — to expand the list of potential buyers, said Michael Bell, an attorney at Howard & Howard who specializes in transactions between banks and credit unions. The move can drive up the price even if a credit union is not the winning bidder, he said.

“I do believe finally after all of these years that small banks and the professionals who sell them realize that including a credit union is a positive,” Bell said.

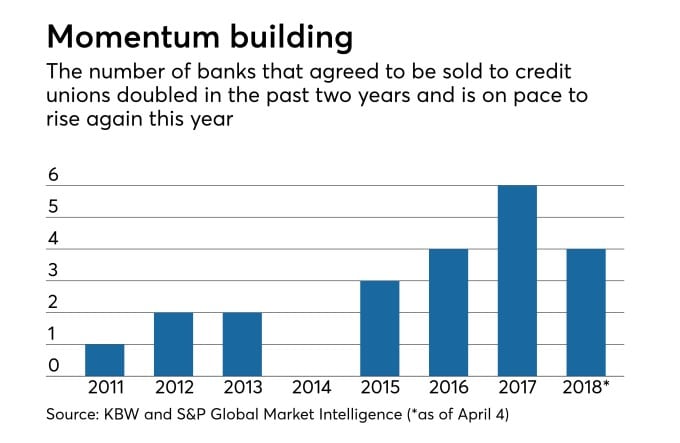

So far this year, four banks have agreed to be sold to credit unions. That matches the number of such deals from all of 2016 and is just two shy of the total in 2017. Given the competitive pressures on community banks, growth-minded credit unions are expected to continue to pursue bank M&A deals.

“The folks marketing these transactions are doing a nice job of getting the word out,” said Peter Duffy, a managing director at Sandler O’Neill. “Then there are the same forces that are affecting the overall merger trend. It is a difficult operating environment.”

Bell said he works with roughly 150 credit unions with the necessary capital, management experience and desire to buy a bank and is currently working on roughly 20 of these deals, though he predicted not all of them will be finalized.

Acquirers have less interest in the smallest banks than they did 15 years ago, said Thomas Rudkin, a principal who oversees M&A and strategic business development for DD&F Consulting Group. Because of that, smaller institutions looking to sell may be particularly open to considering a credit union as a buyer.

The average asset size of banks sold to credit unions last year was $150 million, though even that number was inflated because of Lake Michigan Credit Union’s purchase of the $397 million-asset Encore Bank — the largest bank to sell to a credit union since at least 2011, according to data from Keefe, Bruyette & Woods and S&P Global Market Intelligence.

The average size of a bank that sold to another bank was $473 million last year, the KBW and S&P data also show.

“It takes the same amount of effort to buy a smaller bank than it does for a larger bank,” Rudkin said. “As the banks get smaller, it is harder to find buyers for them. Credit Unions are the ones you have to go to when you have a client that is that small in size. To them, a bank with $70 million of assets is perfectly fine.”

Mergers between credit unions, which are nonprofit cooperatives, are difficult to reach, so credit union leaders with expansion in mind may turn to buying a bank, experts said. No money changes hands when credit unions combine with each other, so the directors and management team of the sellers must have other motivations. Moreover, deals between two credit unions are usually smaller than those that involve a bank, making a transaction with a bank more appealing, Duffy said.

Gary Elliott, president and CEO of Superior Choice Credit Union in Superior, Wis., agreed that credit unions are often more reluctant sellers. A deal with credit unions usually involves “talking them into it,” he said. “You have to sell the sizzle.”

The $414 million-asset Superior’s deal to buy Dairyland State Bank in Bruce, Wis., was more straightforward, he said. Superior learned that the $79 million-asset bank might want to sell, decided the transaction could feed its growth and benefit its members, and made an offer that was eventually accepted, Elliott said.

Elliott, who had worked at banks for more than two decades, believes integrating the bank into the credit union once the deal closes won’t be a problem. He has hired commercial lenders from banks at Superior and believes that community banks and credit unions have similar philosophies in wanting to serve their customers and communities.

Elliott said he would be open to buying more banks but not anytime soon. Credit unions have to pay for acquisitions in cash so the institution will increase its capital levels before striking another deal.

“We recognize that growth is key to continuing to having a prosperous credit union,” Elliott said. “We are continuously trying to improve our membership value proposition, and the only way to do that is to continue to grow and achieve economies of scale.”

Meanwhile, the increased deal activity could inflame already tense debates over the federal income tax exemption and field-of-membership rules for credit unions.

“You have these policy issues out there, and those policies need to be addressed by Congress,” said Keith Leggett, who runs the blog Credit Union Watch. Credit union acquisitions of banks blur the distinctions between the charters and beg the question whether they should be treated equally, he said.

Senate Finance Committee Chairman Orrin Hatch, R-Utah, sent a letter to National Credit Union Administration Chairman J. Mark McWatters earlier this year questioning whether credit unions had outgrown their tax-exempt status.

Ken Clayton, executive vice president of legislative affairs and chief counsel at the American Bankers Association, argued that the growing number of credit unions buying banks “seems to make [Hatch’s] point” that there are no significant differences between the two industries.

“If they are one in the same, why is the government picking winners and losers?” Clayton said.