Banks see a long road to mobile payments

U.S. financial institutions expect it will take another two to five years before consumers broadly adopt mobile payments, and most banks see more obstacles than opportunities in supporting these emerging payment technologies, according to a new study by the Federal Reserve Bank of Boston.

Sixty-three percent of banks and credit unions said mobile payments at the point of sale won’t become ubiquitous until at least 2022, though 20% believe mobile payments could take hold widely within two years, the study suggests.

The report draws on survey data collected from 706 banks and credit unions in seven different Federal Reserve Bank districts completed in the fall of 2016, representing 8.7% of all banks and 3.1% of all credit unions nationally.

The majority of respondents, 81%, said fewer than 5% of their customers who are enrolled with a mobile payments regularly use the service for transactions.

But mobile payment services are steadily accelerating, with one-quarter of all U.S. banks capable of supporting in-store mobile payments and 40% planning to add the technology within the next two years, as financial institutions respond to competitive pressure, the Boston Fed said in a Friday press release. Another 36% said they have no plans to adopt mobile payments technology.

Based on forecasts from the survey data, most banks already support third-party mobile wallets. Nearly all support Apple Pay or plan to do so; 84% support Android Pay and 70% are supporting Samsung Pay, according to the study.

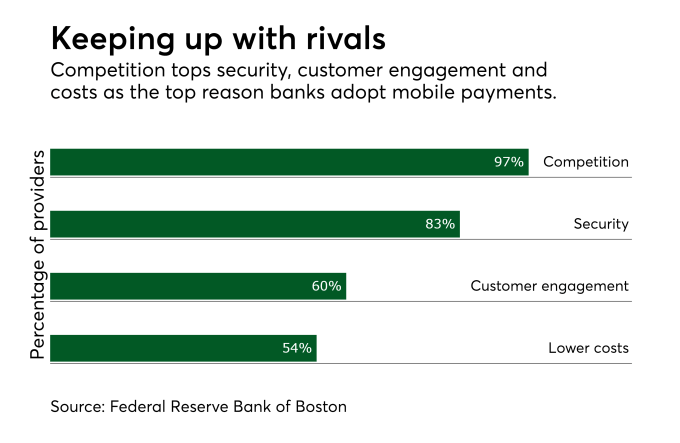

Pressure to keep up with other banks and nonbanks is the top reason financial institutions say they’re adopting mobile payments, according to the report. Secondary reasons include improved security and customer engagement, and the opportunity to cut costs or generate new revenues, the results suggest.

Sixty-seven percent of survey respondents said they plan to partner with a third-party payment processor to deliver mobile payment services. Thirty-six percent said they plan to partner with a payment card network for mobile payments, and 4% said they plan to develop their own mobile payment solution.

Implementing mobile payments takes time, the survey notes. Sixty percent of respondents said it took at least six months to implement support for a third-party mobile wallet support, with the biggest chunk of time devoted to waiting for card network certification. About 20% took three months to do the work and 17% finished the job in less time than that.

Top reasons banks gave for not yet implementing mobile payments included security concerns, lack of customer demand, regulatory issues, lack of a business case and limited benefits to the organization, plus lack of industry standards and interoperability.

Banks said their biggest worries about mobile payments security included inadequate protections around consumer behavior, uncertain mobile device security, ongoing high rates of account takeover and card-not-present fraud, data breaches and inconsistent authentication methods.

Other major obstacles to implementing mobile payments included low merchant acceptance, lack of merchant interest, lack of customer demand and consumer privacy concerns, survey respondents said.