5 things to know about the future of wearable payments

As contactless payments become more ubiquitous in certain European and Asian countries, wearable payments technology is seeing a dramatic increase in adoption. This is particularly true for the devices themselves — such as Apple Watches and Fitbit fitness bands — that may have been recently given as gifts during the holiday season.

Despite the convenience wearable payments hold, there are still obstacles that remain. Some factors are cultural, such as cash usage, or even more deep seated in the human mind, such as concerns over security.

Here are five facts and figures that could influence the future of wearable payments growth.

Probably the most important driver of wearable payments volume growth is the overall popularity of the devices themselves.

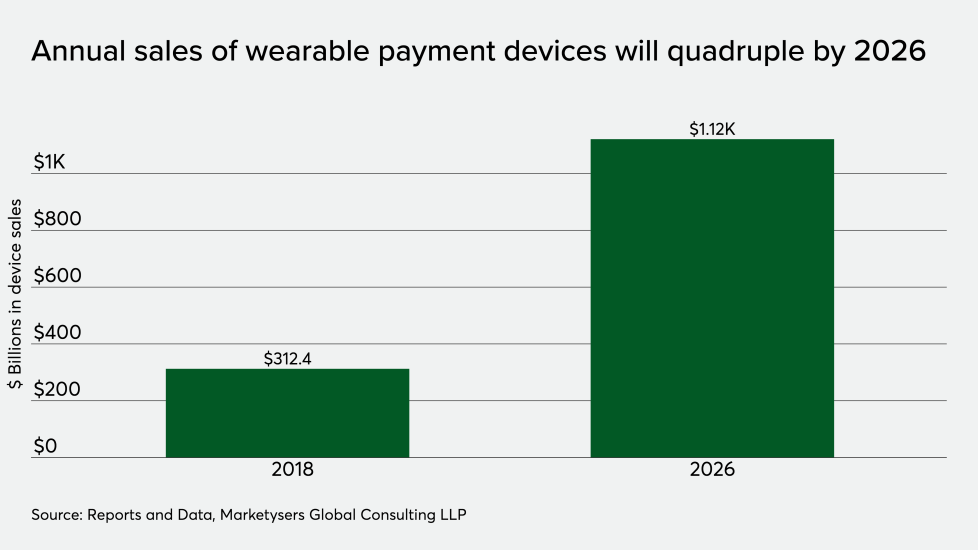

Consumers are expected to increase their already strong demand for wearable payment-enabled devices such as fitness bands, rings, watches, etc. well into the future. According to market research and consulting firm Reports and Data, the global wearable device market is expected to grow from $312 billion in 2018 to over $1.1 trillion in 2026, representing a 15.3% compounded annual growth rate.

Factors driving the growth of wearable devices include the increased adoption of cashless transactions for everyday use, reduced costs of enabling NFC acceptance at merchants, a near-ubiquity of contactless acceptance at POS terminals and the expanded adoption of event-specific wearable devices in lieu of cash at venues such as festivals and concerts.

Challenges facing the growth of wearable payments include device security concerns, the high cost of wearables such as Apple Watches, and the limited battery life which can sometimes leave a user stranded unless they have an alternative such as a physical card or even cash.

An important extension of consumer wearable payment usage is the state of overall contactless payments adoption, most of which today is done through contactless cards and NFC-enabled mobile payments.

According to contactless transaction data from Visa, certain markets such as the U.K. and Canada reached the tipping point in June 2018, when almost half of Visa transactions were tendered using contactless methods. In certain other European and Asia Pacific markets the adoption rates were even higher — over 90% of all Visa transactions in Australia and the Czech Republic were completed through contactless means.

The U.S. market in contrast has continued to lag behind its global peers in adoption with less than 1% of Visa transactions being contactless as of June 2018.

However, it should be noted that one advantage international markets have had over the U.S. in driving contactless adoption has been their earlier move to EMV chip-enabled cards. For example, the U.K. began promoting EMV in 2002 and rolled it out in 2006 while the U.S. EMV liability shift occurred in 2015 across most retail.

While transit applications are often touted as the easiest and quickest ways for banks, merchants and card networks to drive wearable payments adoption since it’s often an extension of contactless payments, that doesn’t appear to be the case in the Netherlands.

Based on data from Mastercard’s Q3 2019 contactless market share report, Dutch consumers are leaders when it comes to wearables payment adoption in Europe. This is despite the fact that for the Dutch, contactless transit is not yet the norm, and in many cases, such systems are still in pilot.

Much of the Dutch wearable payments adoption has to do with the fact that contactless acceptance is nearly ubiquitous across the nation and there is a strong desire for flexibility in payment choice.

“In our country [The Netherlands], the ability to use wearables has been greatly enabled by an ecosystem change. In 2012, the main banks decided to go contactless, so now 99% of all terminals accept contactless,” said Arjan Bol, country manager for the Netherlands at Mastercard.

Cash is often a competitor to other payment methods due to its high level of convenience, however, its ownership grip on that attribute is waning.

Based on 2019 Diary of Consumer Payment Choice from the Federal Reserve Bank of San Francisco, most consumers between the ages of 25 to 64 have shown a decline in cash usage for transactions over the last three years. The steepest decline in cash usage was among 35 to 44 year old consumers, often considered Gen Xers, which have almost halved their cash usage in the last three years.

The biggest contributing factors leading to the decline in cash usage overall and especially for Gen Xers is the increased adoption debit cards for payments, added with fewer low-value transactions being conducted and the growing use of electronic payments. Cash is still used for 49% of transactions under $10 and for 33% of transactions between $10 and $24.99. However, for transactions between $25 and $49.99, its share is only 16% and it drops precipitously thereafter for larger transactions.

Additionally, check usage — which had also been a cash alternative at some point in history — is practically non-existent among consumers under age 45. Even for consumers age 45 to 54, checks represent just 5% of overall payment transactions and only 9% for seniors 65 and older.

Ease of use, speed of transaction, convenience and ubiquitous acceptance are often discussed as obstacles that need to be overcome to drive stronger wearable payments adoption rates, but this list fails to address one key consumer concern — security.

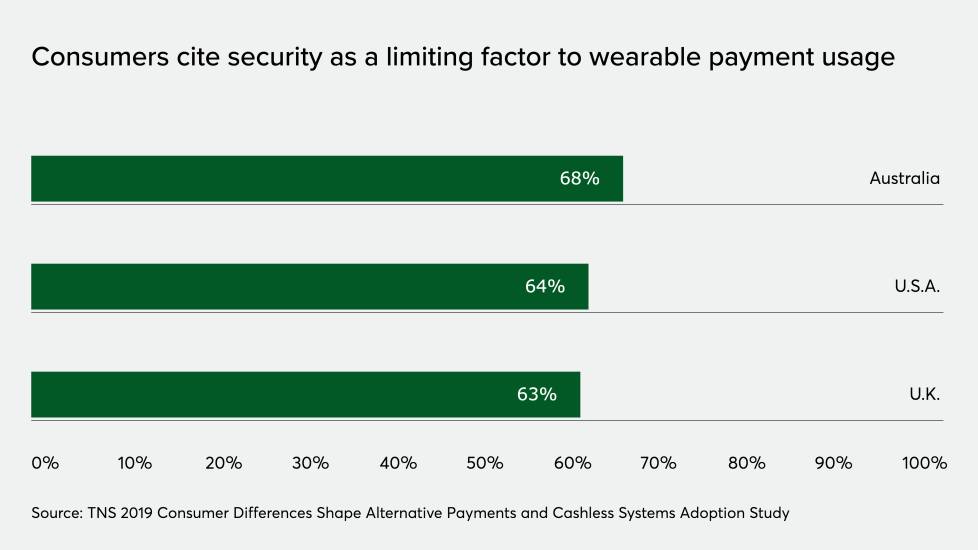

According to a TNS Consumer Differences Shape Alternative Payments and Cashless Systems Adoption Study of 3,000 adults in the U.S., U.K. and Australia, security is a major concern standing in front of broader wearable payments adoption.

Over two-thirds of Australians (68%) and an almost equal percentage of Americans (64%) and Britons (63%) expressed that security concerns would stop them from using a wearable device to make a payment. Despite these concerns, about 44% of overall survey respondents said that they are willing to make a payment using a wearable device like a ring or a bracelet.

Security concerns for wearable payments can be strengthened by the use of biometrics for certain devices such as Apple Watches or Fitbit fitness bands. However, in the case of bracelets used at concerts and festival venues, lower transaction limits in combination with a PIN can be a more effective way to allay security concerns for temporary wearable devices.